Fidility Bank, one of Nigeria’s tier-11 banks, is granting loans to its staff at 3.5 percent interest rate while lending credit facilities to manufacturers at 36 percent.

According to Fidelity Bank’s 2024 full-year financial statement, its staff owed the bank N14.698 in loans and advances as of December 2024, and they got them at an average rate of 3.5 percent.

“Loans to Staff members include mortgage loans and other personal loans. The loans are repayable from various repayment monthly cycles over the tenor and have an average interest rate of 3.5%. Loans granted to staff are performing,” the bank noted.

But at of the end of 2023, the staff of Fidelity Bank owed the financial institution N14.117 billion at the same interest rate.

Fidelity Bank, others charge high rates to manufacturers

The bank, which is between tier-1 and tier-II, lent to its staff at a 3.5 percent rate even when manufacturers got loans from the same bank at 36 percent in 2024. Nigerian manufacturers struggle to have access to credit for expansion as banks like Fidelity lend to them at 36 percent but grant credit to its staff at 3.5 percent.

READ ALSO: Banks’ interest rates are impoverishing Nigerians

Zenith Bank, on the other hand, charges manufacturers 38.5 percent interest rate on loans but allows its key management personnel to collect credit at 4 percent, Economy Post earlier reported.

Access Bank also grants loans to its associates and management personnel at 8 percent interest rate while providing the same support to customers and businesses at rates between 27.6 percent and above, Economy Post reported.

Fidelity loans

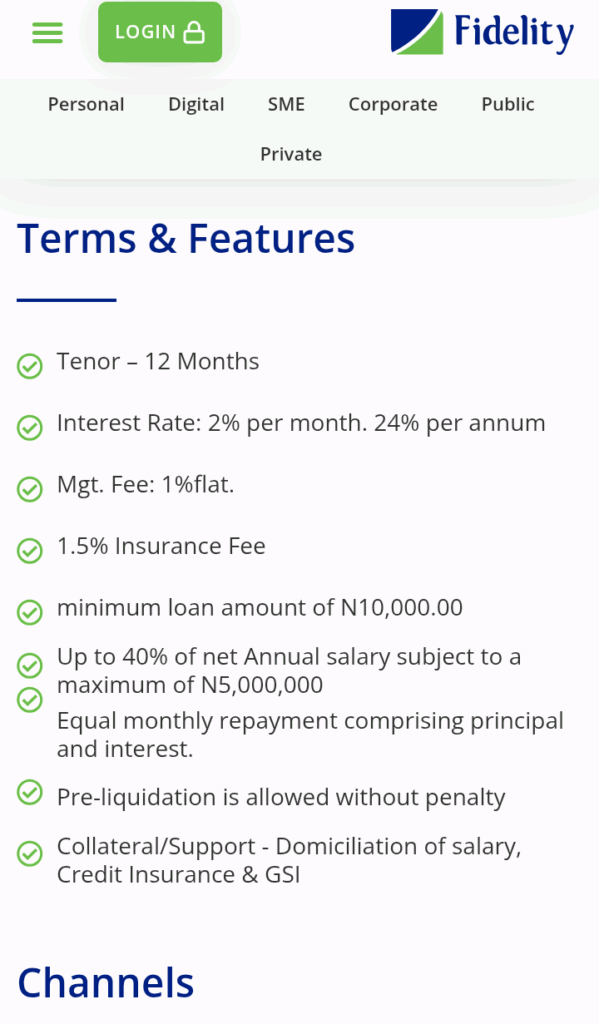

Economy Post found old lending rates for individual and small business loans on Fidelity Bank’s website. Most of the bank’s personal loans are taken at 24 percent interest rate, plus 1 percent management fee and 1.5 percent insurance rate, making it 26 percent. However, this was an old rate before the Central Bank of Nigeria (CBN)’s monetary policy rate (MPR) hikes.

Ordinarily, the CBN’s monetary policy rate (MPR), also known as the benchmark interest rate, determines what banks charge on loans. Commercial or deposit money banks claim they must charge rates above the MPR to make profits. The MPR currently stands at 27.50 percent, meaning, according to them, they won’t make profits if they charge below the MPR. By that logic, it is impossible for Fidelity Bank or any other bank to charge rates below 27.50 percent.

Insiders told Economy Post that Fidelity Bank’s loans range from 35 percent to 40 percent, just like many of its peers.

Bank staff enjoy, manufacturers lament

While bank staff staff have access to credit at far cheaper rates, manufacturers and small businesses, who create jobs and grow the economy, do not. This is because First City Monument Bank, Rand Merchant Bank, Zenith Bank, Fidelity Bank, Eco Bank, and First Bank of Nigeria charge them an arm and a leg for loans, precluding them from accessing capital needed for expansion.

According to data obtained from the Central Bank of Nigeria (CBN), First City Monument Bank (FCMB) had the highest lending rate to manufacturers at 45 percent as of February 2025. In fact, the bank raised its interest rate to manufacturers from 30 percent in February 2021 to 45 percent in February 2025, indicating an increase of 15 percentage over the four-year period.

FCMB is followed by Rand Merchant Bank which, incidentally, raised its lending rate to the group to a whopping 45 percent in February this year from 30 percent in 2021. With 45 percent interest on loans, a manufacturer who borrows N1 billion from FCMB must return N1.450 million in 12 months.

READ ALSO: Access Bank grants loans to associates at 8% interest rate, charges customers 28%

Similarly, Rand Merchant Bank increased its lending rate to manufacturers to 44.5 percent as of February 2025 from 17.5 percet four years ago. By implication, a manufacturer who borrows N100 million from Rand Merchant Bank will repay N144.5 million in 12 months.

Zenith Bank increased its interest rate for manufacturing loans from 30 percent in 2021 to 38.5 percent in 2025.

First Bank of Nigeria raised its lending rate to manufacturers to 36 percent from 24 percent, while Eco Bank increased its rate to 35 percent from 25 percent four years ago. Hence, a small-scale manufacturer who borrows N1 million from First Bank will repay N1.36 million in 12 months. If the producer borrows the same amount from Eco Bank, they will repay N1.35 million within the same period of time.

Moreover, Sterling Bank raised its manufacturing lending rate to 37 percent from 30 percent, while Access Bank increased its own rate to 33 percent from 28.5 percent. Also, Fidelity Bank’s rate remained static but high at 36 percent over the four-year period, while Guaranty Trust Bank’s rate stood at 29 percent from 23 percent. Furthermore, United Bank for Africa raised its own rate to 32 percent from 24 percent. Also,

An economist, Dr Doyin Oladokun, wondered how banks would expect manufacturers to borrow “at very high rates” and repay in 12 months.

“You simply can’t have development if you continue to lend at 35 percent – 45 percent to manufacturers. They can’t create jobs and can’t even repay the loans. We are not yet serious as a nation,” Dr Oladokun said.

“China’s prime lending rate (LPR), which is equivalent to our monetary policy rate (MPR), is 3 percent to 3.6 percent for 1-year to five-year loans. Yes, you can argue that the inflation rate there is less than 1 percent, but they have a series of development funds for manufacturers where they can even borrow at rates below the market rate.

“Here in Nigeria, it is traders, bankers and Ponzi scheme drivers who get credits at lower rates. Isn’t that a shame? We need to wake up as a nation.”

An operator of a small business and Chief Executive Officer of Lagos-based Jasen Fashions, Ms Jane Idemudia, said the situation only reflects the state of Nigeria’s financial system.

“It is a laughable situation that a bank pays more attention to its staff than those without which it cannot be in business. As an entrepreneur, we hardly have access to cheap loans. Even when government intervention loans are available, you cannot access them unless you know someone in a bank. So, this situation is just a reflection of what the country’s banking system has become,” she said.

Fidelity Bank keeps mum

Fidelity Bank did not comment when asked to explain why its staff get loans at cheaper rates while customers access the same credit at far expensive rates. Its Divisional Head, Brand & Communications, Mr Meksley Nwagboh, did not respond to Economy Post‘s questions, though he had earlier promised to answer them.

economypost.ng