…GTB is involved in 466 cases as the plaintiff

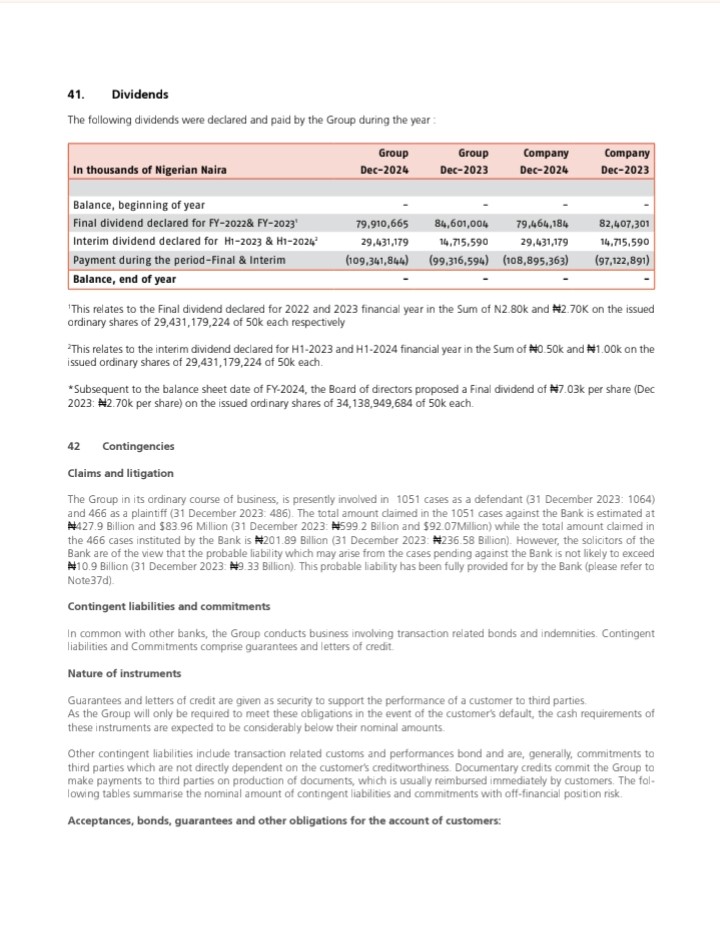

Guaranty Trust Bank, also known as Guaranty Trust Holding Company (GTCO) Plc, was involved in 1,051 court cases as of the end of 2024, with customers and other entities demanding N427.9 billion and $83.96 million. Some of the cases are still ongoing.

According to the GTCO’s 2024 financial statement, seen by Economy Post, the number of the bank’s litigations fell by 13 to 1,051 in 2024, from 1,064 by December 2023.

The bank was also not a pushover as it sued its customers and other external entities 466 times, demanding N201.89 billion.

GTB, as the financial institution is popularly known, demanded N236.58 billion in its 486 cases as of December 2023. Hence, the bank had 20 more cases against customers and other entities in 2024 than in 2023, demanding N34.69 billion more from them.

In 2024, GTB set aside N10.9 billion to take care of legal cases and possible judgments against it.

“The Group in its ordinary course of business, is presently involved in 1051 cases as a defendant (31 December 2023: 1064)

and 466 as a plaintiff (31 December 2023: 486). The total amount claimed in the 1051 cases against the Bank is estimated at

N427.9 Billion and $83.96 Million (31 December 2023: N599.2 Billion and $92.07Million) while the total amount claimed in

the 466 cases instituted by the Bank is N201.89 Billion (31 December 2023: N236.58 Billion).

“However, the solicitors of the Bank are of the view that the probable liability which may arise from the cases pending against the Bank is not likely to exceed

N10.9 Billion (31 December 2023: N9.33 Billion). This probable liability has been fully provided for by the Bank (please refer to

Note37d).”

Same as 2023

In 2023, GTB had 932 court cases from aggrieved customers and other parties.

Economy Post learnt from the bank’s half-year 2023 financial statements released to the Nigeria Exchange Group that the litigants demanded N595.9 billion and $24.05 million in damages and refunds from the tier-1 bank.

As at December 2022, litigations against the bank numbered 842, with litigants demanding N609.5 billion and $33.08 million in refunds and damages. But the number of litigations rose by 90 in six months to June 2023. GTB lawyers believed at that time that the bank’s liability was far less than what is being claimed by the litigants.

“However, the solicitors of the Group are of the view that the probable

liability which may arise from the cases pending against the Group is not likely to exceed N880.23 Million (31 December 2022: N527.18 Million). This probable liability has been fully provided for by the Group (please refer to Note 37),” the bank said.

Recent GTB cases

Innoson Group, a GTB customer, had instituted a case against the bank in 2011, claiming “excessive and unlawful charges” by the financial institution.

The vehicle assembler subsequently said that the bank owed it N8.9 billion in annual compounded interest.

In 2019, Innoson claimed ownership of GTB, saying that a judgment had given a nod to the company to take over the bank. Innoson said the apex court upheld a ruling earlier given at a federal high court in Ibadan in that light. The bank, however, denied Innoson’s claim.

There was an uproar at that time, especially as the Supreme Court dismissed GTB’s appeal in the February 27, 2019 ruling delivered by the Court of Appeal, Ibadan, Oyo State.

But in 2023, the apex court reversed its earlier ruling, re-admitting the GTB’s appeal, according to The Punch.

Similarly, The Punch reported in 2024 that GTB dragged 60 top executives of 13 commercial banks to court over a pending suit involving over a N17 billion Anchor Borrowers Programme loan.

GTB also had a case last year with a staff member named Ms Zaveria Njeri Wanjohi in Nairobi, Kenya. Ms Wanjohi contended that she was unfairly dismissed, but the Labour Relations Court dismissed her case. However, the court awarded her damages of 45,000 shillings against GTB.

A GTB spokesperson did not respond to enquiries on the state of some of bank’s litigations.

economypost.ng